Get the free 8557501663

Show details

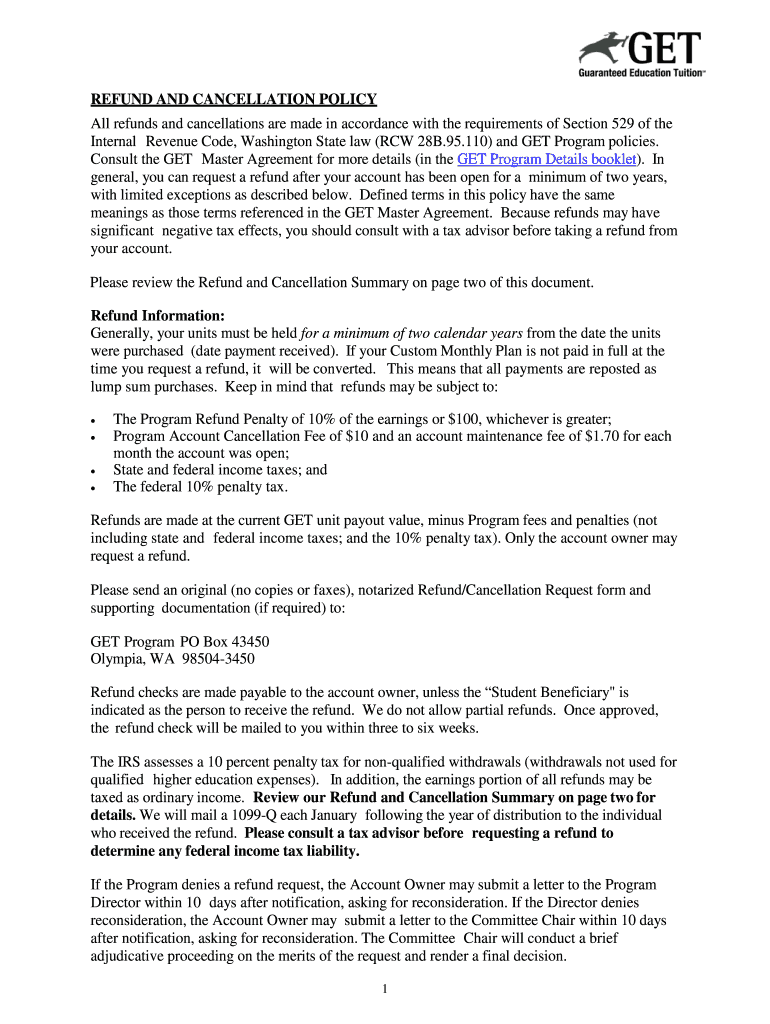

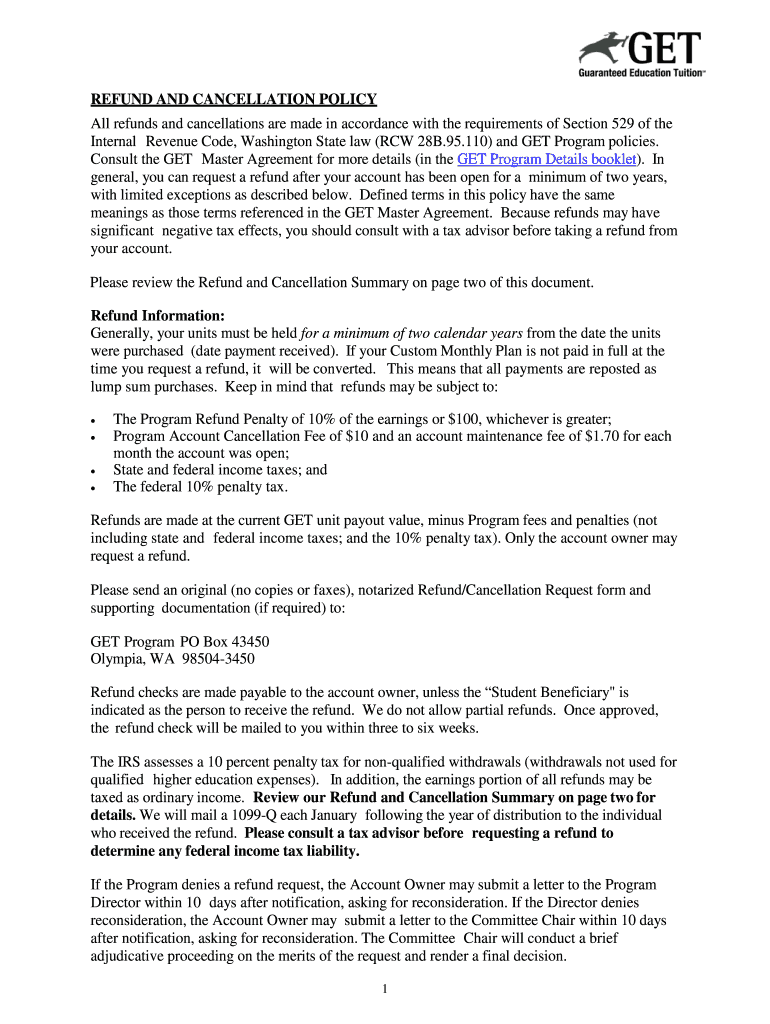

REFUND AND CANCELLATION POLICY

All refunds and cancellations are made in accordance with the requirements of Section 529 of the

Internal Revenue Code, Washington State law (RCW 28B.95.110) and GET

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 855 750 1663 form

Edit your supportpdffill form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your supportpdffi form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit purchase support pdffi online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit pdf pro io cancel subscription form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out supportpdf form

01

To fill out 8557501663, you need to first gather all the necessary information required to complete the form.

02

Next, carefully read the instructions provided on the form to ensure you understand the required fields and any specific guidelines.

03

Begin by entering your personal details accurately, such as your name, address, and contact information.

04

Follow the order of the form and fill in each section accordingly, providing the requested information or selecting the appropriate options.

05

Double-check all entries for any errors or omissions before proceeding.

06

If there are any additional sections or attachments required, ensure you complete them as instructed.

07

Finally, review the entire form once again to ensure accuracy and completeness before submitting it.

For who needs 8557501663:

01

8557501663 may be required by individuals or organizations who need to provide their contact information or complete a specific application or registration process.

02

It may be necessary for individuals seeking a particular service, membership, or assistance to fill out 8557501663.

03

Some businesses or institutions may require individuals to fill out 8557501663 for record-keeping purposes or to comply with legal or regulatory requirements.

Fill

supportpdffile

: Try Risk Free

People Also Ask about 855 7501663

What is support ?

is an essential tool for digitizing document processes and reducing paperwork hassles. Edit or fill out PDF documents on any device, create fillable PDF forms and share them online, sign or send documents for eSignature, save time with reusable templates, and securely manage documents in the cloud.

What are the charges for ?

has 3 different plans: Basic at $8.00 per month. Premium at $30.00 per user per month. airSlate Business Cloud at $50.00 per user per month.

How do I cancel a and get a refund?

Here is how you can cancel your subscription. Log in on the website. Click on the “My Account” tab. Choose the “Cancel Subscription” button. Follow the next steps to confirm.

Is a legit company?

complies with major security standards and regulations such as PCI DSS, HIPAA, SOC 2, and the U.S. ESIGN act of 2000. These standards help us manage customer data, preserving security and confidentiality as required under the GDPR.

Can you cancel subscription?

Here is how you can cancel your subscription. Log in on the website. Choose the “Cancel Subscription” button. Follow the next steps to confirm.

Is a legitimate site?

complies with major security standards and regulations such as PCI DSS, HIPAA, SOC 2, and the U.S. ESIGN act of 2000. These standards help us manage customer data, preserving security and confidentiality as required under the GDPR.

What is charge?

Pricing Basic: $20/month/user (monthly billing) or $8/month/user (annual billing) Premium: $40/month for up to 3 users (monthly billing) or $15/month for up to 3 users (annual billing) Plus: $50/user/month (annual billing)

Can I get my money back from ?

You can request a refund (see our Refund and Cancellation policy, available on the Forms page, for details).

Is a legitimate company?

complies with major security standards and regulations such as PCI DSS, HIPAA, SOC 2, and the U.S. ESIGN act of 2000. These standards help us manage customer data, preserving security and confidentiality as required under the GDPR.

Is really free?

does not have a free version but does offer a free trial. paid version starts at USD 20.00/month.

Will give me a refund?

You can request a refund (see our Refund and Cancellation policy, available on the Forms page, for details).

Where is located?

is located in Brookline Village, Massachusetts, United States .

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify support filler com without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including support pdf file charge. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit supportpdf charge online?

With pdfFiller, the editing process is straightforward. Open your support pdf in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I fill out support d filler on an Android device?

On an Android device, use the pdfFiller mobile app to finish your wwultrapdf cancel subscription. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your 8557501663 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pdfruncom Charge On Credit Card is not the form you're looking for?Search for another form here.

Keywords relevant to support filler

Related to support pd filler

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.